For well over a decade now there’s been a concerted push to revitalize manufacturing in the U.S. And while there has certainly been anecdotal evidence to support this vision, more than enough evidence existed to indicate a renaissance in American manufacturing would not occur for many more years—if it ever fully materialized at all.

During the peak COVID years, however, things began to accelerate on several fronts. These factors were highlighted at the 2023 Manufacturing in America event in Detroit, sponsored by Siemens and Electro-Matic.

Raj Batra, president of Siemens Digital Industries USA pointed to three key aspects that have either occurred or accelerated since the advent of COVID.

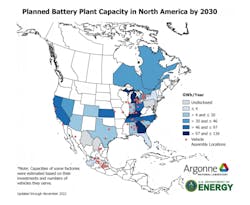

$108 billion in spending on new plant construction in the U.S. in 2022, according to the Census Bureau. “That’s the highest total on record,” Batra said, with much of it being spent on developing manufacturing industries related to electrification and battery facilities (see accompanying map of U.S. battery facilities). According to CNBC: Georgia, Kentucky and Michigan are going to dominate electric vehicle (EV) battery manufacturing in the United States by 2030. Kansas, North Carolina, Ohio and Tennessee will also be key players. This EV battery manufacturing capacity will support the manufacturing of 10-13 million all-electric vehicles per year, putting the U.S. in position to be a global EV competitor.“Too many people talk about U.S. manufacturing in the past tense—about how it was,” said Garlin Gilchrist, Lt. Governor of Michigan, at the Manufacturing in America event. “But gatherings like this are about the future. And one of the most important results from federal and state programs and incentives [for manufacturing] supports the idea that integration and collaboration is key to innovation.”

Transformational technologies

In a conversation between Batra and and Tom Kelly, CEO of Automation Alley (a non-profit Industry 4.0 knowledge center and home to the World Economic Forum’s U.S. Center for Advanced Manufacturing), Kelly noted that what’s possible in manufacturing today with new technologies is not happening because these technologies are not yet in many plants, especially the smaller ones that comprise the bulk of U.S. manufacturers.

The new technologies Kelly contends will be key to manufacturing’s future are artificial intelligence (AI), 3D printing/additive manufacturing and collaborative robots (cobots).

While AI and cobots receive most of the attention today, Kelly is particularly enthusiastic about the transformational potential around 3D printing. He noted that many companies still view additive manufacturing as a prototyping tool, but he sees that viewpoint changing as more people learn how the technology is being used to manufacture production-ready parts and recognize the cost value of it.

“The cost points [in favor of 3D printing] will flip not at the piece part price, but in comparison to the costs to tool up a facility [to make parts with traditional technologies],” Kelly said. “You’ll start to see more additive manufactured parts at price points that you wouldn’t think will be competitive, but they will be because of small lot sizes.”

Three examples Kelly pointed to as companies that will change manufacturing’s perceptions of 3D printing are:

Relativity Space—a manufacturer of 3D-printed rockets to carry payloads into orbit. While this development is exciting, Kelly noted that it will be bad for traditional manufacturers in the rocket supply chain because this “will change the industry.”