For more than a decade now, Ethernet has been making big moves into the manufacturing and processing industries and is well on its way to becoming the de facto industrial network. Its flexibility, interoperability, and performance make Ethernet a natural fit for the exchange of factory-floor data with other systems. But due to the prevalence of installed fieldbus networks, it will likely be years before it becomes the dominant industrial networking method.

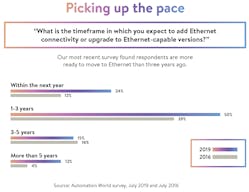

In 2016, Automation World conducted a survey to learn more about the areas in manufacturing/processing facilities in which Ethernet is not yet used—and may never be applicable. At the end of 2019, we did an update of that survey to see how things have changed in the past three years, particularly in light of the increased interest in the Internet of Things (IoT).

Despite proprietary networks’ strong hold over the factory floor, our hypothesis is that industrial Ethernet adoption is (and will be) an increasing part of manufacturers’ Industry 4.0 and digitization initiatives, especially as costs begin to come down.

“The objective is to be able to glean more insights relative to your operations and do analytics on data from plant floor devices. Then you can do productivity improvements and increase safety,” says Eric Knopp, strategic alliance manager for Rockwell Automation. Ethernet is a key enabler. But, confoundingly, our survey respondents did not report connecting more devices to Ethernet in 2019 vs. 2016.

We spoke to prominent automation suppliers to get a reality check on our numbers. They had distinctly different views, not surprisingly, according to where they sit in the industry.

The first survey question (see chart, on page 36) asked about devices that are not connected via any form of Ethernet (Ethernet TCP/IP or fieldbus over Ethernet). The data seem to show not much has changed in the past three years. This could be attributed to margin of error, or it could indicate that there has not been much movement since we did the first survey.

Many suppliers felt the lack of movement to Ethernet likely indicates the migration was already complete a few years ago. “We just don’t see a lot of hardwired or legacy device buses like DeviceNet or Profibus anymore,” says John Kowal, marketing director of B&R Industrial Automation.

Rockwell Automation saw a significant inflection point in Ethernet migrations among its customer base back in the early 2000s, according to Doug Weber, business manager for network products/Ethernet IP networking products. “That was when the migration to Ethernet really ticked up. Today, approximately 90% of our ControlLogix controllers are tied to Ethernet communications.”

Ethernet adoption is very customer specific, adds Knopp. “It’s typically tied more to the size and sophistication of the customer than it is to the industry.” In some cases, the engineering or controls engineers are able to put together a business case that ties increased production to converting over to Ethernet.

“The much more common dynamic we see is customers will wait to make the journey to Ethernet until their machine-level assets are expiring,” says Knopp. “We have customers that are running 15- to 20-year-old control systems in parts of their operations. They can improve throughput or something else. That is the opportunity for network upgrades. People don’t rip out equipment just to get a new network.”

Jason Haldeman, senior product marketing specialist for I/O and gateways at Phoenix Contact, has observed customers take a similar trajectory. “We saw a high rate of adoption from ’06 to ’09, when there was incredible growth. It’s been more modest the last few years.”

Belden sees steady annual increases in demand for Ethernet. “Our customers are using proprietary protocols like Databus and Fieldbus but they want to transition to a standard Ethernet protocol and bring everything to cloud for IoT/analytics,” says Sylvia Feng, product line manager for industrial Ethernet and Databus products at Belden.

“It’s about the flexibility of sharing information on the same network. We use the same cable to send different pieces of information, providing openness, interoperability, speed, reliability, and built-in redundancy,” says Feng. As an added bonus, it is easier to maintain one protocol versus multiple.

On the other hand, Ethernet has not completely taken over the industrial landscape, she says. “We still see a stable demand for Databus products. We were expecting the Ethernet would grow faster and the proprietary protocols would start to decrease, but the growth in Ethernet is not as fast as expected.” Manufacturers may be worried about possibly exposing their critical plant-floor networks to cyber-attack via Ethernet connectivity, she adds, though there are certainly many technologies and practices that help protect against intrusions.

“Databus networks are relatively simple and direct. They are more secure and deterministic. Many in OT [operational technology] want to stay where they are,” says Feng. This is especially true for small to mid-size companies.

“In a small manufacturing plant, if the current DeviceNet is working and they don’t need high bandwidth for video streaming or wireless access points, then there really is not a huge incentive to take out the current network, which is well-established and understood, and change to Ethernet,” says Feng.

By contrast, industries that face sky-high costs of downtime such as certain cells in automotive, food/beverage, consumer packaged goods (CPG), and oil & gas tended to be early adopters of Ethernet, says Feng. Their migrations are long done and therefore won’t appear in recent survey results that discuss migration plans, perhaps skewing the results to look artificially low.

Still no Ethernet at the sensor level

The fact remains, it still does not make sense to connect all industrial devices to Ethernet. The first concern is cost. It’s widely viewed as too expensive to connect plant-floor sensors via twisted-pair Ethernet. The 2016 and 2019 survey results corroborate this notion, with respondents saying about 50% of sensors on average remain disconnected from Ethernet.

Another hurdle: most Ethernet-based plant-floor networks do not offer power over Ethernet functionality. That means each Ethernet-based device would require a separate interface for power. The result is bulkier devices and increased integration costs, says Shishir Rege, technical sales specialist for Balluff.

But these considerations may be fading. Several device-level communication standards, such as IO-Link, offer data communication and power over the standard sensor cable, enabling these devices to integrate without additional cost while providing the intelligence required on the plant floor. The rise of these technologies reduces the burden of integration and makes them scalable in the future, when the plants are ready to take next steps with Ethernet-based networks at the control level.

“Single-pair Ethernet and power over data lines will become a lot less expensive. We’ll see a lot more instrumentation of smaller devices into Ethernet,” says Haldeman.

The so-called “last meter” that connects I/O with sensors is an area of focus for a number of technology suppliers. “Single-pair Ethernet removes the obstacles and argument,” says Haldeman. “You’ll start seeing a major transition. Once it gets down to the sensor, it will make sense to have Ethernet everywhere.” That may figure into the somewhat accelerated adoption plans seen in the two sets of survey results (see chart on page 38).

Then there’s the perennial driver of migration: The prospect of losing support for their legacy networking equipment. Roger Yue, business development manager, Moxa, says 50% of its customers were pushed to buying/using new Ethernet-based instruments due to the imminent loss of software driver support from their suppliers.

He’s seeing an increasing number of engineering teams moving over to the new generation of Ethernet equipment. Three years ago, there was a widespread perception that the cost of Ethernet connectivity was high. “Today, Ethernet chip sets are mature and the costs are coming down.”

In the grand scheme of things, given the increasing number of new Ethernet-capable technologies as well as the strong hold proprietary networks still have in the industrial setting, three years could be viewed as a short timeframe to consider Ethernet migration plans. What is certain is that, in coming years, there will be a lot more adoption of Ethernet-based technologies in the plants for variety of reasons—primarily to remain competitive and viable in the marketplace by implementing condition monitoring, data analytics, predictive maintenance, and traceability on the plant floor.